Using Tax Exchanges to Help Propel Your Wealth!

Use of Tax Exchanges to Propel Your Wealth!

(The proper execution of a Tax Exchange when you sell land or other real estate can save you a pile of taxes and accelerate your long term wealth)

By Rich Waite

Imagine this: It’s late August and you are at a family cook-out when your cousin (let’s call him Earl) starts blabbing to you while you are flipping burgers about the rural farm land he just sold for $125,000 profit. Wow. Nice going Earl! Later he proudly states, in between bites of bar-b-Que, that he paid NO taxes on the sale. That’s right he paid Zippo for real estate taxes! Whoa! You nearly drop you lemonade in your lap! Earl is in big trouble — and I mean big TROUBLE- you are thinking! It won’t be long and the Fed’s will come looking for good old Earl!

Not so fast!

Don’t forget that Earl knows his stuff. Earl didn’t just fall of the cabbage truck yesterday. Earl is an experienced investor and keeps in touch with his trusty tax manager when it comes to things like this and he knew what he was doing before he ever sold his farm. Earl had plans! And his plans were to do a 1031 Tax Exchange with any and all of the capital gains he received on the sale of his farm.

What, you say – a 1031 Tax Exchange?

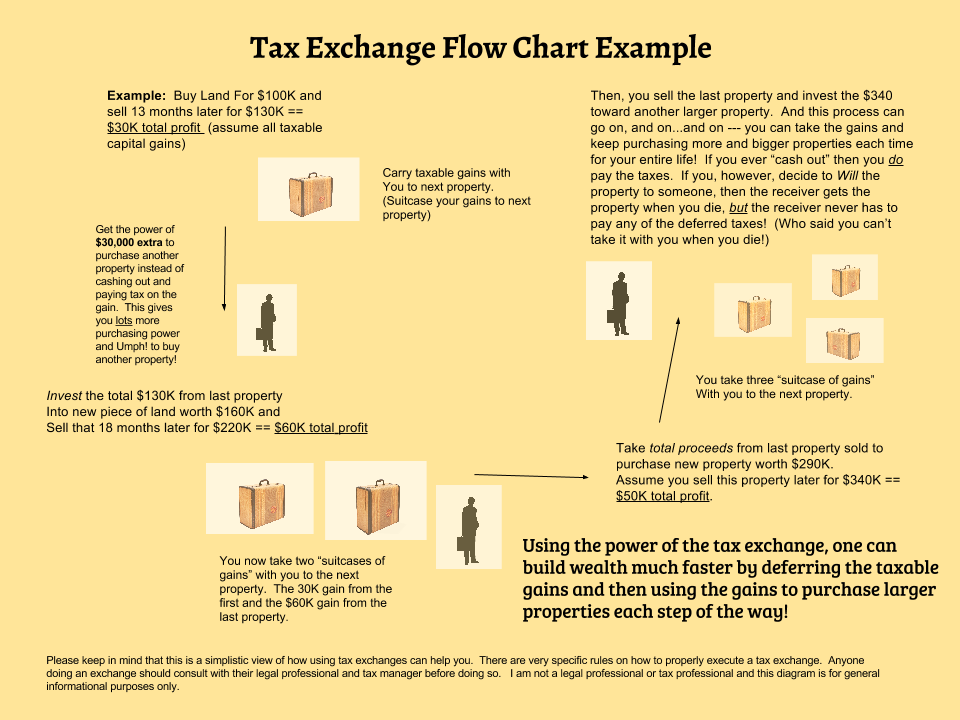

That’s what they are called and what a tax exchange allows one to do is to defer or delay any taxable gain on a sale of one property to another like-kind property. That is powerful stuff! You can move the gain from one property – without paying taxes on it – to help pay for another similar type of property! The process is simple and complex all at the same time. It’s simple because the gist of what they allow is this: to carry taxable gains from one property into another property – to delay those gains until you sell that property or elect to move the gains from that sale also to another property. This process is sort of a domino effect on building wealth. Each step along the way you are building more long- term potential wealth faster by using all the profits from each sale to put into the next, without paying taxes at that time.

Imagine this. You are on a canoe trip and you are canoeing down the river. You come to an island. It’s the island that you had forgotten you owned! You decide to sell the island to your friend Bob while having a beer around the campfire that night. Bob agrees. You take the $10,000 gain that you made on that sale with you in the canoe until you come to another island down the river. Lucky you – the island is for sale. You buy the island with the help of the $10K profit. Great…you own another island! A year later you decide to sell that island and make a $22k profit from it. Back in the canoe it goes and you come to another island that happens to be for sale. Out comes the $22K to help pay for it!……you get the idea. The profits from each sale “ride with you” or “carry” to the next property. (whether you are canoeing down a river or not). When you sell the next property any gains from the sale of that property are taxed along with the original gains that you deferred. But– and this is a big BUT — You can defer both of those gains again and again and again for as long as you live with the use of the tax exchange!

Finally, should you decide to “Will” the final property that you have to someone else, the receiver (beneficiary) gets that property when you die — and he/she doesn’t have to pay for any of the back gains that you had to help get you to that property in the first place! All the gains are forgiven and the adjusted basis the receiver of the property has is usually the present appraised market value of that property. (This would be used to determine any gains the beneficiary may or may not have if he/she should ever decide to sell the property).

Incredible!

Here’s a Flow Chart of the basic tax exchange process:

KEEP IN MIND WHEN DOING THIS that the backbone of the process is really rather simple – it is just buying and selling – but the tax exchange rules are strict and complex. You NEED to use a good real estate attorney and what’s called a qualified Intermediary to help you properly and legally carry out a tax exchange. These professionals will help you ensure that the process is done correctly and that all the rules are followed. This is critical because not following the rules will ensure that the tax exchange will not legally be allowed and that any capital gains will need to be paid at the time of the sale.

Keep in mind that this article is for reference and illustration only. I am not a tax professional or legal professional. I assume no responsibility for anyone acting on what I say. You must use a competent real estate attorney and you should consult with your tax manager before ever considering a 1031 Tax Exchange. Using a qualified intermediary is also mandatory. However – don’t let these mandated things scare you away! The legal professionals carry out the details for you. That is what they are getting paid for. Really, as an investor, all you need to do is find the deal and bring it to them! Have fun!